Alberta TIER’s 2024 retirements:

What does this mean for future prices?

July 8, 2025

June 30th was the deadline for facilities to meet their 2024 compliance obligations for Alberta’s TIER industrial carbon pricing regime. To satisfy their obligations, facilities with obligations were required to either retire Emission Performance Credits (EPCs) or Offsets or purchase compliance credits from the Alberta government’s TIER Fund.

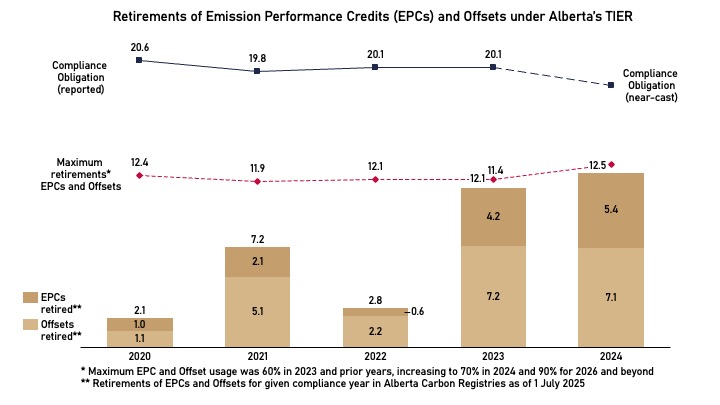

From Alberta Carbon Registries data, we calculate that 12.5 million tonnes of EPCs and Offsets were retired to satisfy emitters’ 2024 compliance obligations.

For 2024, the maximum EPCs and Offsets that an emitter could retire was 70% of its obligations. From our “near-casting” of 2024 obligations (based on our facility-level model for the TIER regime and end-of-year operational data across facilities), these actual retirements closely tracked our estimate of the maximum potential retirements for 2024 compliance.

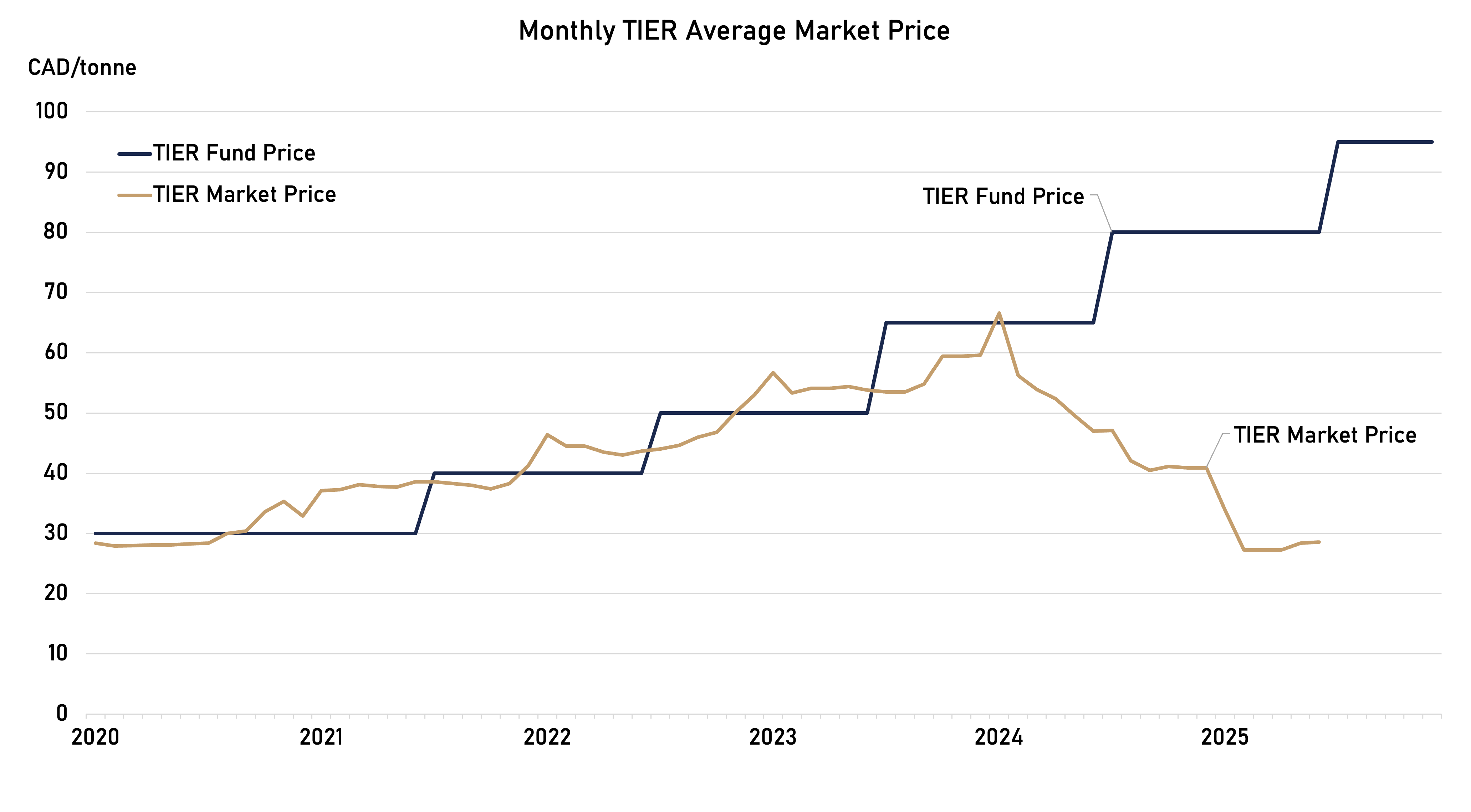

Prices for TIER EPCs and Offsets have traded roughly $30/tonne through the first half of 2025. Compared to purchasing TIER Fund credits at $80/tonne price for 2024 compliance, facilities faced a strong incentive to retire currently banked EPCs and Offsets.

For 2025 TIER compliance, TIER Fund credits will cost $95/tonne by ministerial order. However, despite the federal government’s “backstop” schedule for industrial carbon prices to rise to $170/tonne by 2030, the Alberta government has indicated that it will pause on any further increases beyond this year’s $95/tonne.

Nonetheless, quoted prices for EPCs and Offsets remain depressed, far below the TIER Fund price.

Market participants face uncertainty around future policy for carbon pricing and emissions reduction. But the ultimate driver of the discount facing EPCs and Offsets is the current overhang of banked EPCs and Offsets.

If and when the present bank is drawn down – and maximum potential retirements consistently exceed creation of new EPCs and Offsets – the TIER Fund price will be the marginal cost for compliance. At that future time, market prices for EPCs and Offsets should converge with the TIER Fund price. However, until that time, EPCs and Offsets will face a discount to that TIER Fund price – reflecting both the time value of money and risk around future policy and market conditions.

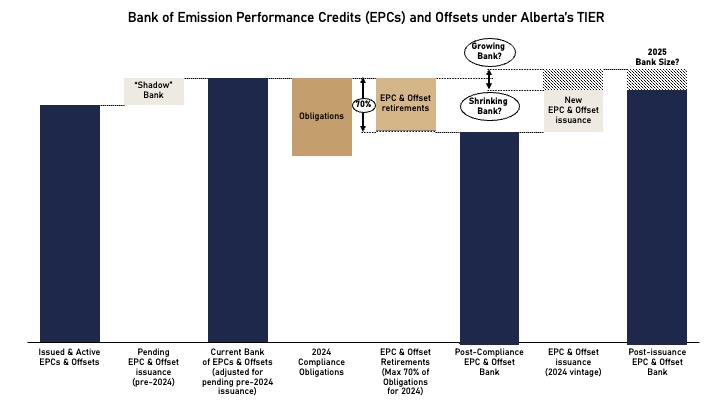

Therefore, understanding how the bank of EPCs and Offsets will evolve over the next years is critical for projecting the fundamental value of EPCs and Offsets under TIER.

To accurately forecast the evolution of this bank, one needs to project the creation of EPCs and Offsets alongside the volume of retirements for a given compliance year.

For example, relative to 2024, will the bank of EPCs and Offsets grow or shrink in 2025? And when will this bank be drawn down?

This depends on accurate forecasts for new EPCs and Offsets, as well as emitters’ future obligations and retirements.

Additionally, an accurate snapshot of the bank requires adjusting for “shadow” EPCs and Offsets that have been earned but have yet to be serialized in the Alberta Carbon Registries. For various facilities, EPCs that have been requested for prior compliance years are not issued for several years, and developers also can lag on verifying and reporting for their offset projects. This “shadow bank” presently tallies millions of pending EPCs and Offsets.

Planning for a new project or acquiring an asset in Alberta that relies on TIER for long-term value requires a robust understanding of this market’s future dynamics.

Based on various facility-level datasets and compliance reporting, our bottom-up modelling across TIER-regulated facilities provides accurate near-casting of each facility’s obligations, EPCs or Offsets and projections for the evolving market balance as well as market pricing. Foundation Economics can help your organization explore a range of scenarios to formulate strategy around Alberta’s TIER regime.