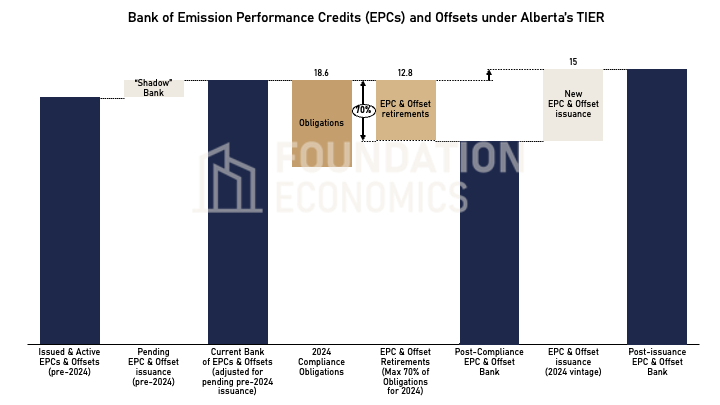

Alberta TIER 2024 Compliance results:

Implications for a growing EPC/Offset bank

November 3, 2025

Despite an increase in 2024 GHGs, obligations under TIER declined. The volume of EPCs and Offsets for 2024 versus the retirements mean a growing EPC/Offset bank – and continuing downward pressure on depressed prices.

Any outcomes of “Grand Bargain” negotiations between Alberta and Canada’s federal government will determine the pace and timeline for the draw-down of the presently ~60 million tonne bank of EPCs and Offsets – and, in turn, the pathway for future EPC/Offset prices.

Read More

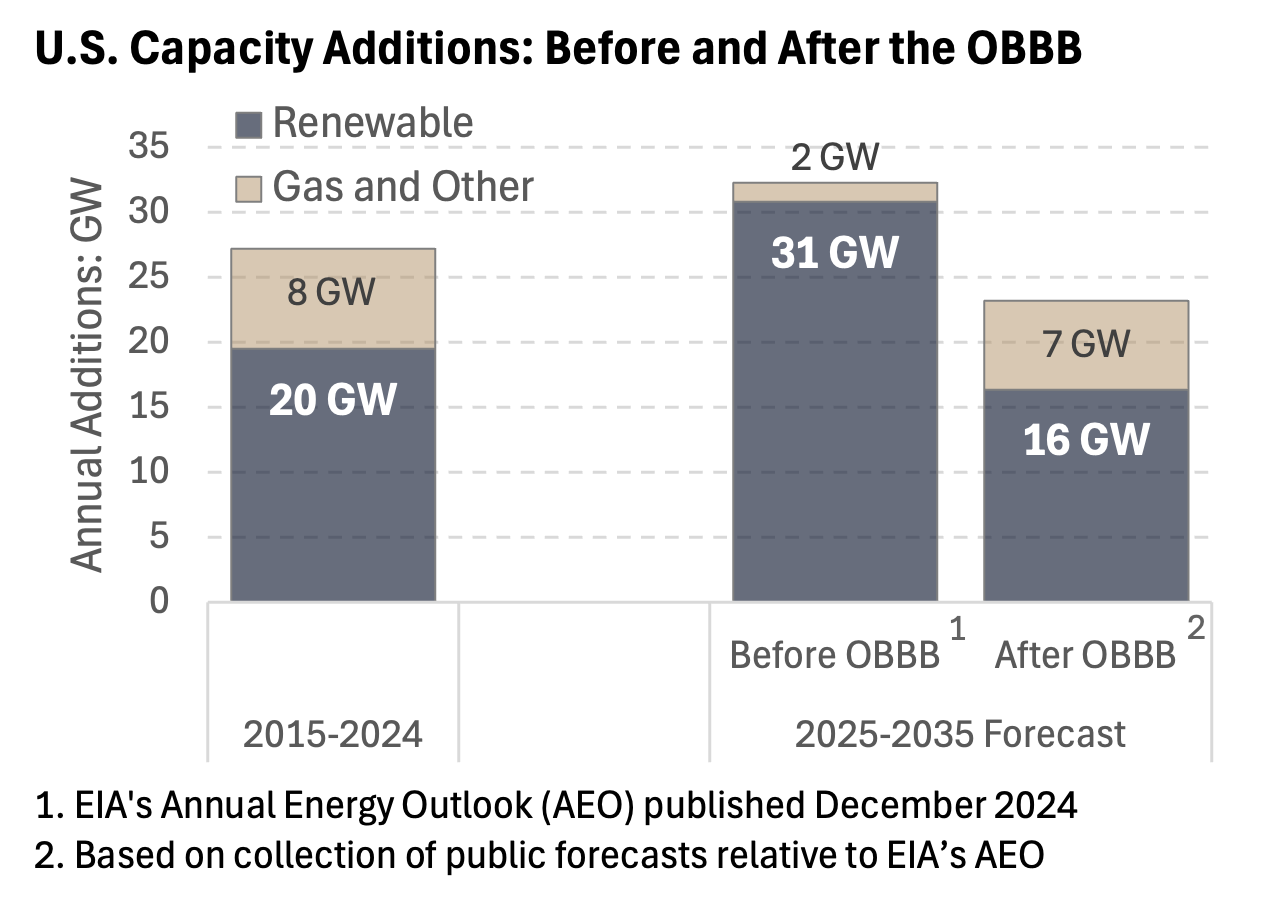

From the Inflation Reduction Act to the One Big Beautiful Bill:

A Sudden Shift for US Renewables

September 16, 2025

As development in the U.S. slows, Canada is in the midst of a sustained build cycle. For IPPs and capital providers with paused growth strategies south of the border, this offers a chance to stay active and continue scaling over the next several years.

Read More

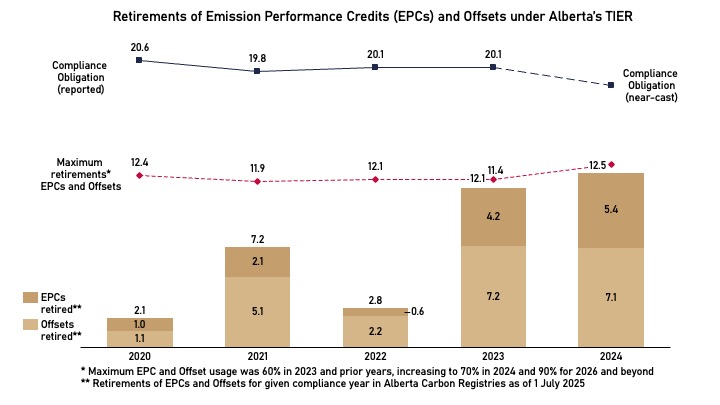

Alberta TIER’s 2024 retirements:

What does this mean for future prices?

July 8, 2025

With Alberta TIER's June 30th compliance deadline now passed, 12.5 million EPCs and Offsets were retired for 2024. This result closely aligns with our bottom-up "near-cast" of obligations across TIER-regulated facilities, and, in this post, we explain what this means for TIER's market balance and future pricing.

Read More

Post-Election Questions for Canadian Carbon Pricing

April 30, 2025

As Mr. Carney’s party shifts from campaigning to governing after winning Monday’s election, how it navigates decarbonizing our economy is pivotal to Canadian competitiveness – now, and for the long run.

Read More