From the Inflation Reduction Act to the One Big Beautiful Bill:

A Sudden Shift for US Renewables

September 16, 2025

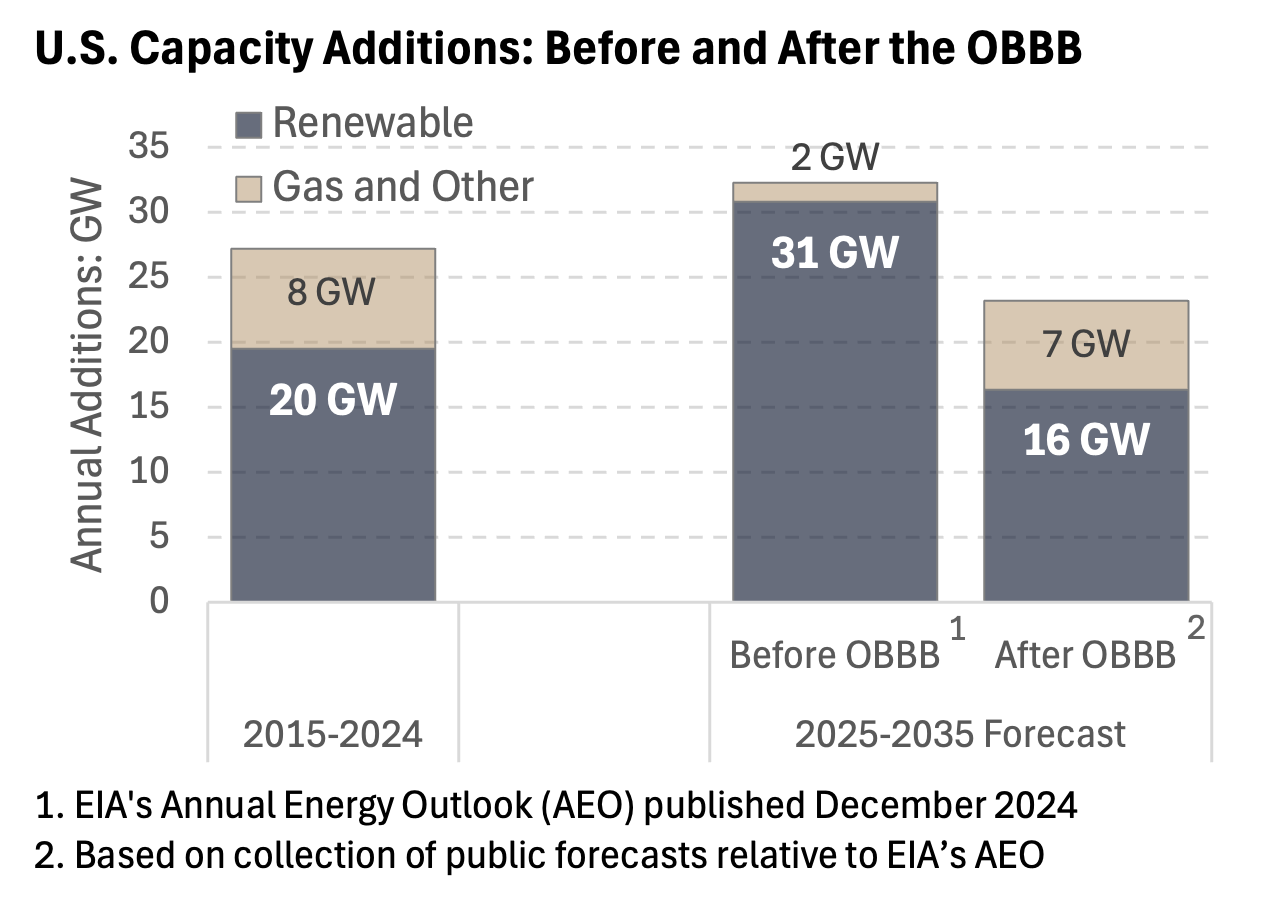

Wind and solar have dominated investment in new U.S. power generation over the past decade. This growth was driven by longstanding federal incentives—primarily the Production and Investment Tax Credits—and the widespread availability of utility PPAs, which largely removed merchant risk and enabled financing at exceptionally low cost. The Inflation Reduction Act was designed to accelerate this trajectory, positioning the U.S. as the global leader in renewables. In addition to extending tax credits, the IRA expanded support for domestic manufacturing of clean energy technologies and unlocked incentives for battery storage—driving the infrastructure needed to integrate higher volumes of intermittent generation into the grid.

The One Big Beautiful Bill (OBBB), passed in early 2025, effectively reverses core elements of the Inflation Reduction Act by accelerating the phaseout of the longstanding federal support for wind and solar. The last projects to receive these incentives must begin construction by the end of 2025 to qualify. After that, wind and solar generation will need to be economic without these subsidies—either by competing directly with new gas generation, relying on explicit support from state programs, or passing higher costs on to ratepayers.

The impact is expected to be immediate. Any project that can reach construction in time will do so. Any project that cannot reach this deadline is likely stalled. Projects that had secured revenue contracts or financing structures but are unable to start construction in time are now likely looking to unwind or renegotiate those agreements—requiring higher prices from to cover the funding gap left by the loss of the ITC or PTC. Utilities and centralized procurement programs are likely pausing or delaying RFPs to reassess cost impacts and give developers time to re-evaluate project viability in a post-tax credit environment.

On top of this, tariffs on imported solar modules—already a source of delay—have been expanded and extended, raising costs and narrowing procurement options for developers. Executive orders from the Trump administration, reinstated in early 2025, have further complicated the permitting process by imposing new environmental review requirements and weakening federal coordination. Together, these measures have amplified investor concerns and cast additional doubt on the viability of near-term development, especially for utility-scale projects in early stages. The result is a sharp cooling in sentiment, even for developers with otherwise viable sites and offtake agreements.

Renewables are still expected to play a significant role in the U.S. power mix over the long run. Demand for electricity is growing at a pace not seen in 30 years, and while gas and nuclear are both expected to expand, their long development timelines will limit how fast they can scale. Renewables will remain a competitive option in many markets—but in the meantime, the sector faces a period of disruption. The next several years will be defined by uncertainty as the market works to determine where renewables can be cost-competitive and how the funding gap left by the loss of federal tax credits will be filled.

Near-Term Fallout: Projects Pause and Developers Consider Growth Strategy

For the past decade, many Canadian and European independent power producers had been following a clear growth strategy centered on the U.S. market. Pension funds and global infrastructure investors were also actively pursuing equity stakes in U.S. renewables and storage projects.

Since early 2025, that momentum has shifted. Public statements from several firms now point to a pause in U.S. development activity, as developers respond to the changing federal policy landscape and re-evaluate where capital can be most effectively deployed.

Quotes from Select European IPPs on the U.S. Policy Environment

| ENGIE | “We are pausing on projects that have yet to reach FID, until we have clarity on future policy…. if needed, we could allocate capital originally intended for the US into other markets”

CEO Catherine MacGregor - Engie’s Q1 2025 earnings call |

|---|---|

| Ørsted | “[Policy risks in the U.S.] have been a key contributor to…shaving 40% ( ~$10 billion) off Ørsted’s market value since the U.S. election”

Jefferies Analyst - May 2025 |

| RWE | “We remain cautious given the political developments … Only if [permits, tax-credit certainty, tariff risks, offtake] are in place will further U.S. investments be possible.”

CEO Markus Krebber, 2025 AGM |

Canada’s Build Cycle Offers Growth During the U.S. Pause

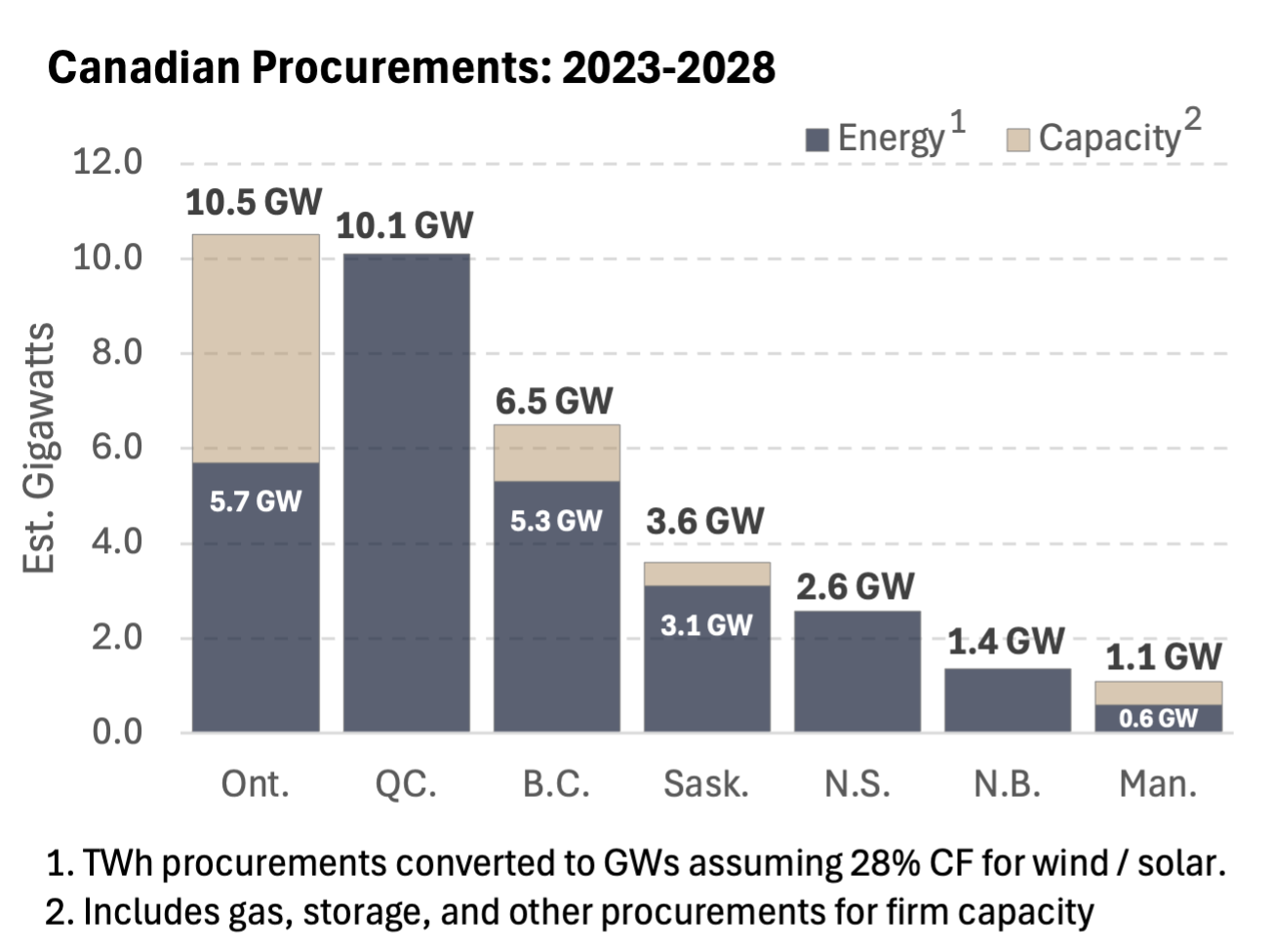

Across Canada, a new build cycle is underway, with nearly every Canadian province actively procuring new generation—offering a near-term growth opportunity for those stepping back from the U.S. market. Procurements are being driven primarily by growing demand, with far less focus on decarbonization targets. Ontario has launched its LT2 procurement and is already preparing for additional rounds.

Québec is responding to surging industrial demand and growing export obligations to the U.S. Northeast. B.C., Saskatchewan, and Manitoba have each announced or initiated new procurement processes after years of limited development activity. Even smaller provinces like Nova Scotia and New Brunswick are entering the market with new capacity and renewable tenders. Ontario is also opening up to corporate PPAs, creating new offtake pathways. This activity comes after a near-complete freeze in development outside Alberta, where Ontario, Québec, and B.C. had not run major competitive procurements since the early 2010s.

For many of the Canadian IPPs that built their portfolios during that earlier cycle, this marks a return to their home market. It’s also drawing interest from European players new to these markets—but with so many firms crowding back in at once, competition for sites, contracts, and interconnection will be high.

Alberta: From Boom to Bust—And What Comes Next

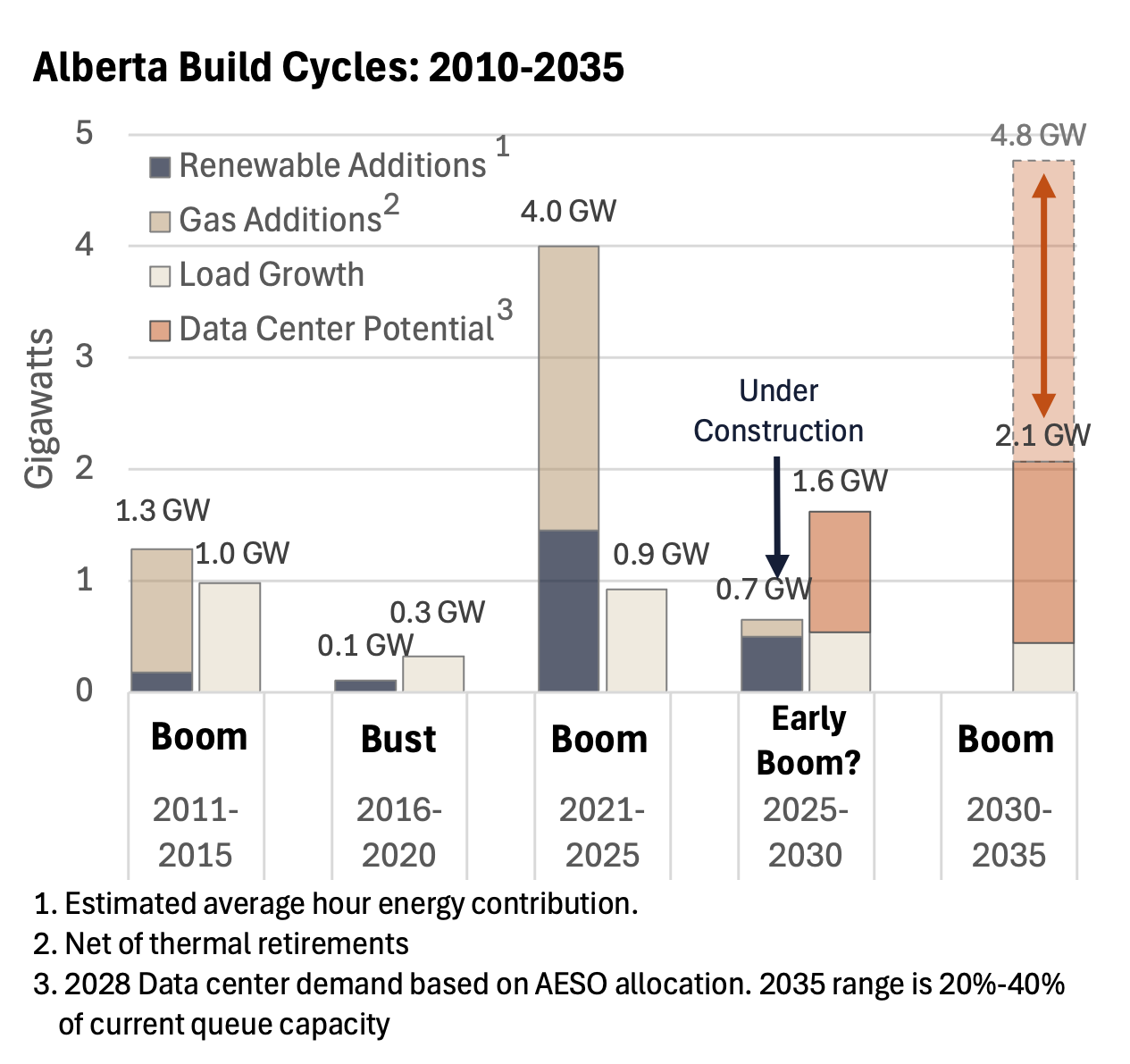

Alberta is a notable exception. From 2018 to 2024, Alberta led the country in new power development—both gas and renewables—driven by coal retirements, steady load growth, and the only merchant PPA market in Canada. Today, the province is oversupplied and with no immediate need for new capacity. Since 2018, 6 GW of renewables have come online, with another ~2 GW under construction and expected by the end of 2026, and 2.8 GW of gas has been commissioned. In response, market prices have fallen back to around $50/MWh—roughly one-third of the levels seen in mid-2023, when tight reserve margins drove prices as high as $140/MWh. The boom in renewables also triggered a policy response: a pause on new development was imposed in 2023 for grid planning, and subsequent rule changes have introduced added uncertainty around merchant revenues and interconnection. At the same time, Alberta’s carbon price has stalled near $30/tonne—well below the federal backstop of $170/tonne that many investors had expected the market to converge toward—adding further uncertainty to future cash flows and dampening investor appetite for new clean energy projects.

Alberta’s downturns have historically lasted around seven years before the next build cycle begins; however, there are strong reasons to believe this one could be much shorter. Load growth fundamentals remain strong. Population growth continues, but the more significant driver is the sudden interest in data center development. The AESO is currently managing a queue of over 15GW of proposed data center load, with the AESO allocating 1,200MW for 2028. Integrating all of the data center demand is not possible, but even adding 20% over the next 10 years would add demand for 2.4 TWh of new generation annually – adding ~3% of new demand to the market every year, or ~900 MW of new wind or solar. Developers and IPPs have taken notice and are already preparing for the next build cycle—with both gas and renewable projects in the pipeline.

Conclusions

As development in the U.S. slows, Canada is in the midst of a sustained build cycle. For IPPs and capital providers with paused growth strategies south of the border, this offers a chance to stay active and continue scaling over the next several years. But competition is intensifying, timelines are compressed, and Canada brings its own set of policy and market risks. Foundation Economics can help you navigate what’s ahead. Watch for supporting charts and data, or reach out to discuss how we can support your strategy.