Alberta TIER 2024 Compliance results:

Implications for a growing EPC/Offset bank

November 3, 2025

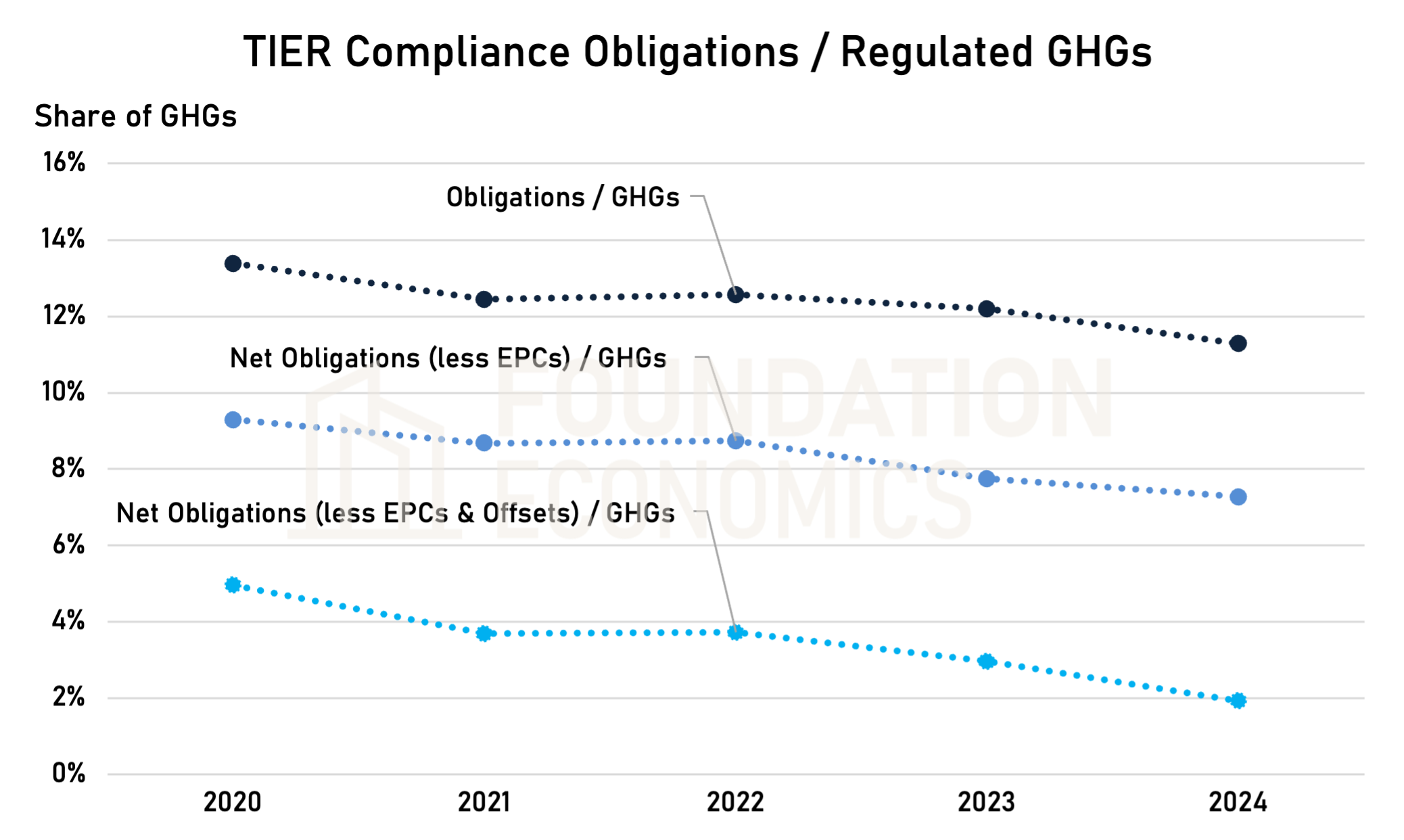

- Despite an increase in 2024 TIER-Regulated GHGs from 2023, compliance obligations under TIER declined and net compliance obligations (less EPCs and Offsets) as a share of GHGs also declined.

- Although benchmarks were generally tightened by 2% across sectors, continuing reductions in emission intensity – particularly for power generation and oil sands production – explain the continued decline in net obligations.

- The volume of requested EPCs and Offset issuance for 2024 versus the retirements to satisfy obligations mean a growing EPC/Offset bank – and consequently continuing downward pressure on depressed EPC/Offset prices.

- Looking ahead, among Alberta's other announced changes to TIER, the opt-out of Aggregate Oil & Gas facilities (which optionally participated in TIER to avoid the so-called "carbon tax") will relatively reduce compliance obligations from 2025 onwards.

- Any outcomes of “Grand Bargain” negotiations between Alberta and Canada’s federal government will determine the pace and timeline for the draw-down of the presently ~60 million tonne bank of EPCs and Offsets – and, in turn, the pathway for future EPC/Offset prices.

In early October, Alberta released 2024 compliance data for its industrial carbon pricing regime under the Technology Innovation and Emission Reduction (TIER) regulation. The results confirmed our projections for emitter obligations and creation of Emission Performance Credits (EPCs), as well as the growing bank of EPCs and Offsets and shrinking net obligations as a share of GHGs.

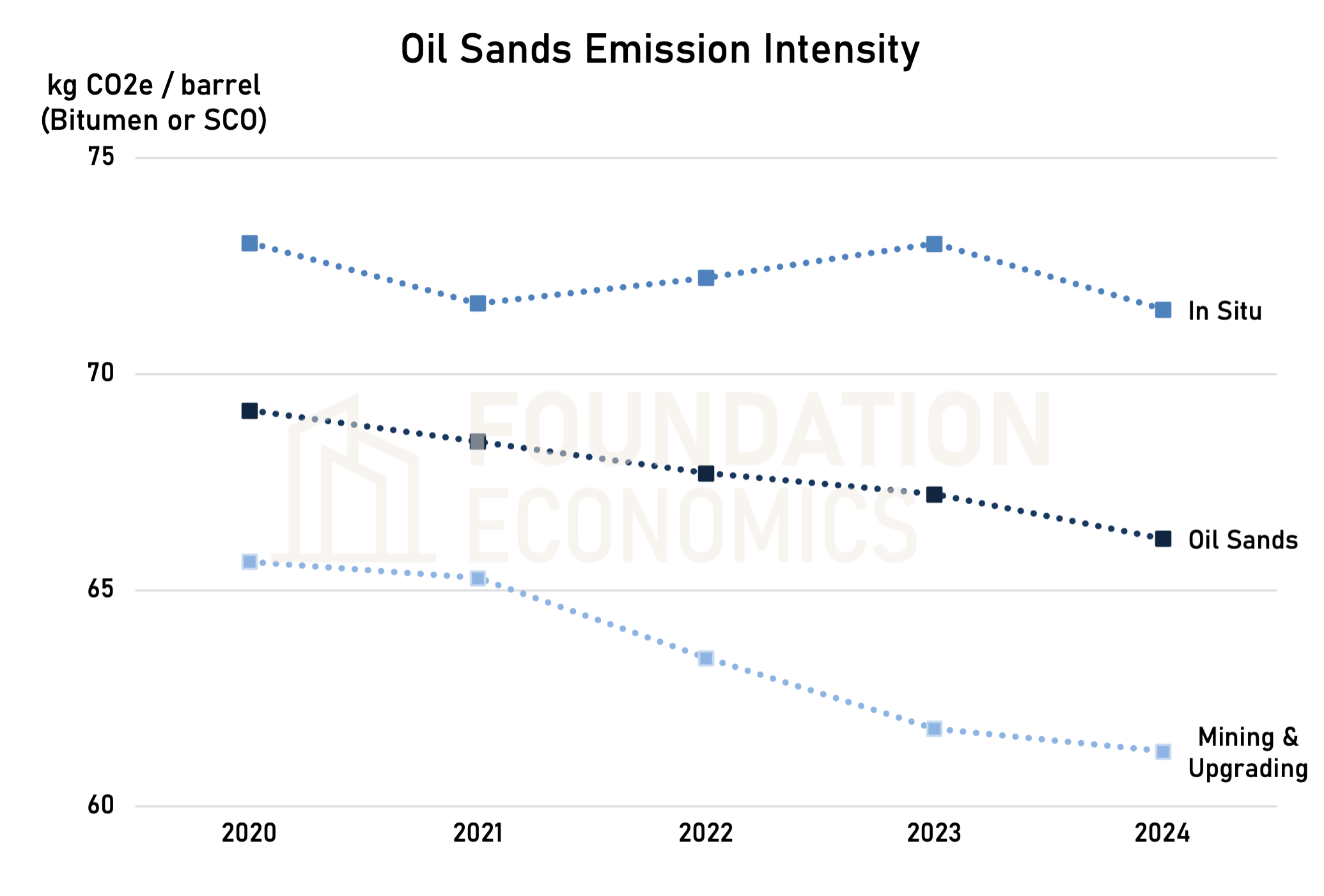

The trend of shrinking net obligations/GHGs follows from reductions in emission intensity in major TIER sectors (oil sands and power plants in particular) outpacing the tightening of benchmark stringency.

The growth of the EPC/Offset bank (with 2024 creation of EPCs and Offsets exceeding retirements) will place continued downward pressure on EPC/Offset prices. Empirically, EPC/Offset prices track the “years of inventory” (the EPC/Offset bank relative to annual obligations). Economically, the TIER Fund price will not “bind” as the marginal cost of compliance – and price of EPCs and Offsets – until the future year at which the bank has been drawn-down and TIER's maximum retirements (90% of obligations for 2026 onwards) consistently exceed EPC/Offset creation.

Looking ahead, although benchmarks will continue to tighten at 2% for the 2025 compliance year, overall obligations for 2025 will be particularly impacted to the downside by the opt-out of most Aggregate Oil & Gas facilities, which no longer have an incentive to participate in TIER after the elimination of the federal fuel levy (the so-called “carbon tax”).

For the longer-term, any negotiated policy agreement between Alberta and Canada’s federal government (the so-called “Grand Bargain” reportedly in discussion) will presumably focus on TIER’s stringency and Fund price, as well as other incentives for large-scale decarbonization investments – particularly the build-out of carbon capture and storage (CCS). This will be determinative for the pace and timing for the draw-down of the EPC/Offset bank.

Foundation Economics has developed a bottom-up forecast model for TIER market balances and EPC/Offset prices from facility-level operational data and compliance reporting.

This detailed modelling provides the basis for our regular market outlooks for clients and equips TIER market participants and investors to explore economic implications for different policy and decarbonization scenarios.

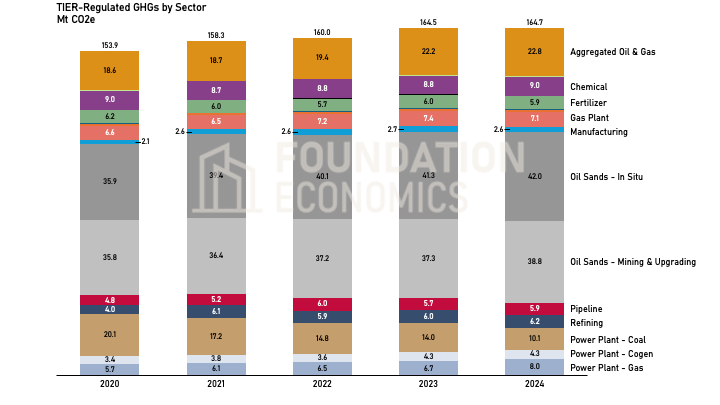

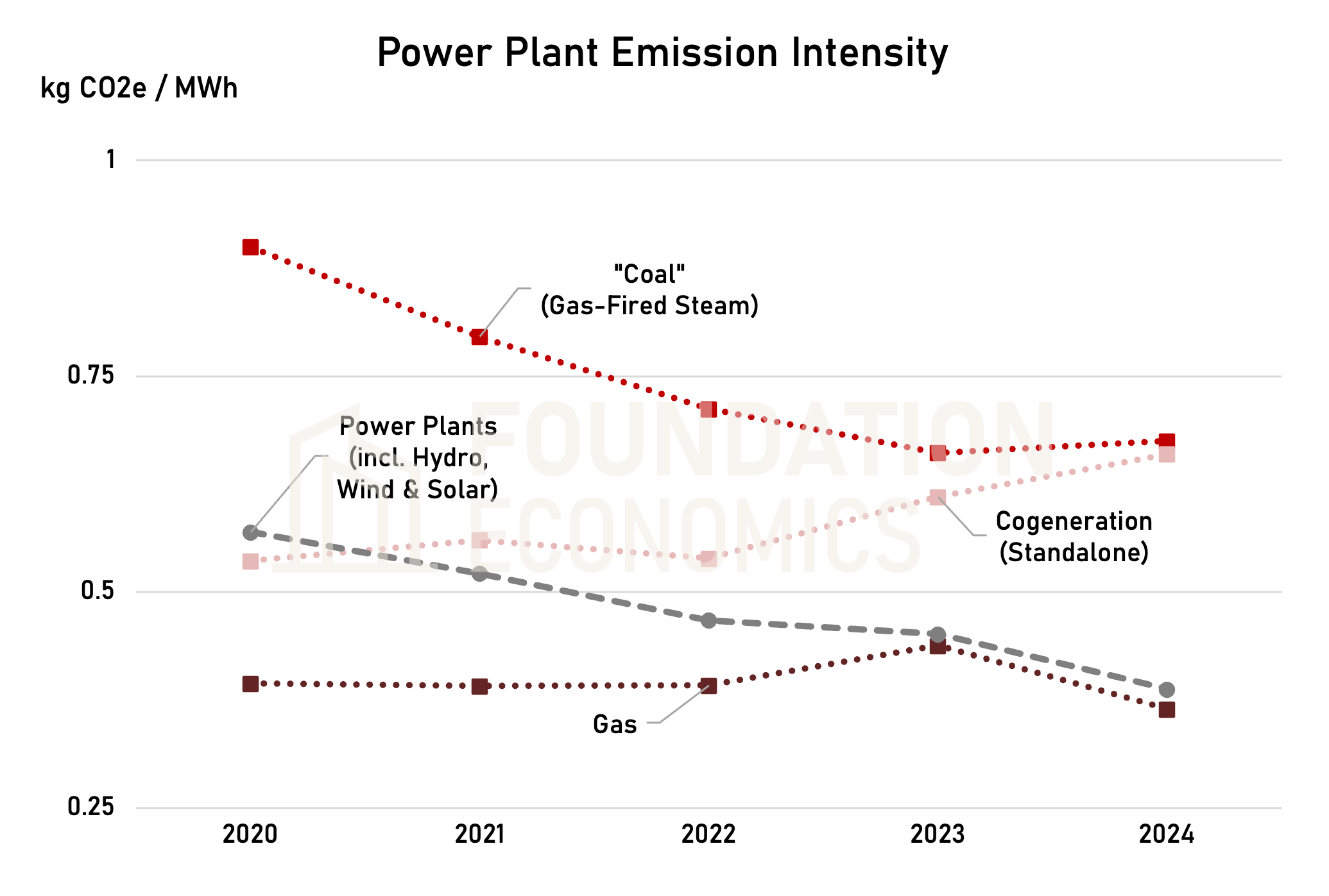

Overall, GHGs regulated under TIER increased slightly from 2023 to 2024. Increases in Regulated GHGs from the Oil Sands, Aggregate Oil & Gas, Refining and Chemicals sectors offset ongoing declines in GHGs from Power Plants (following from the phase-out of coal through plant retirements and conversions to gas-fired generation).

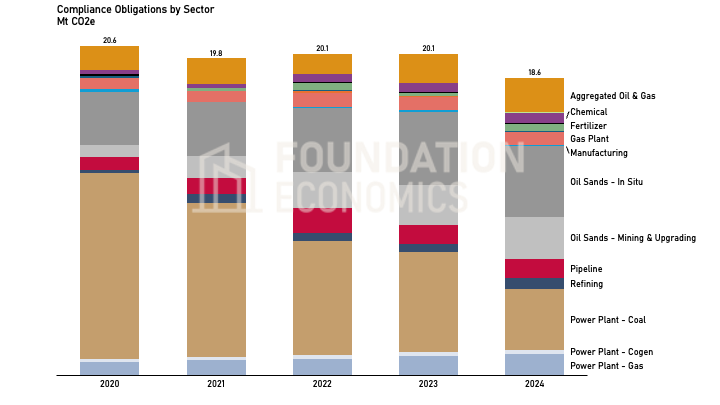

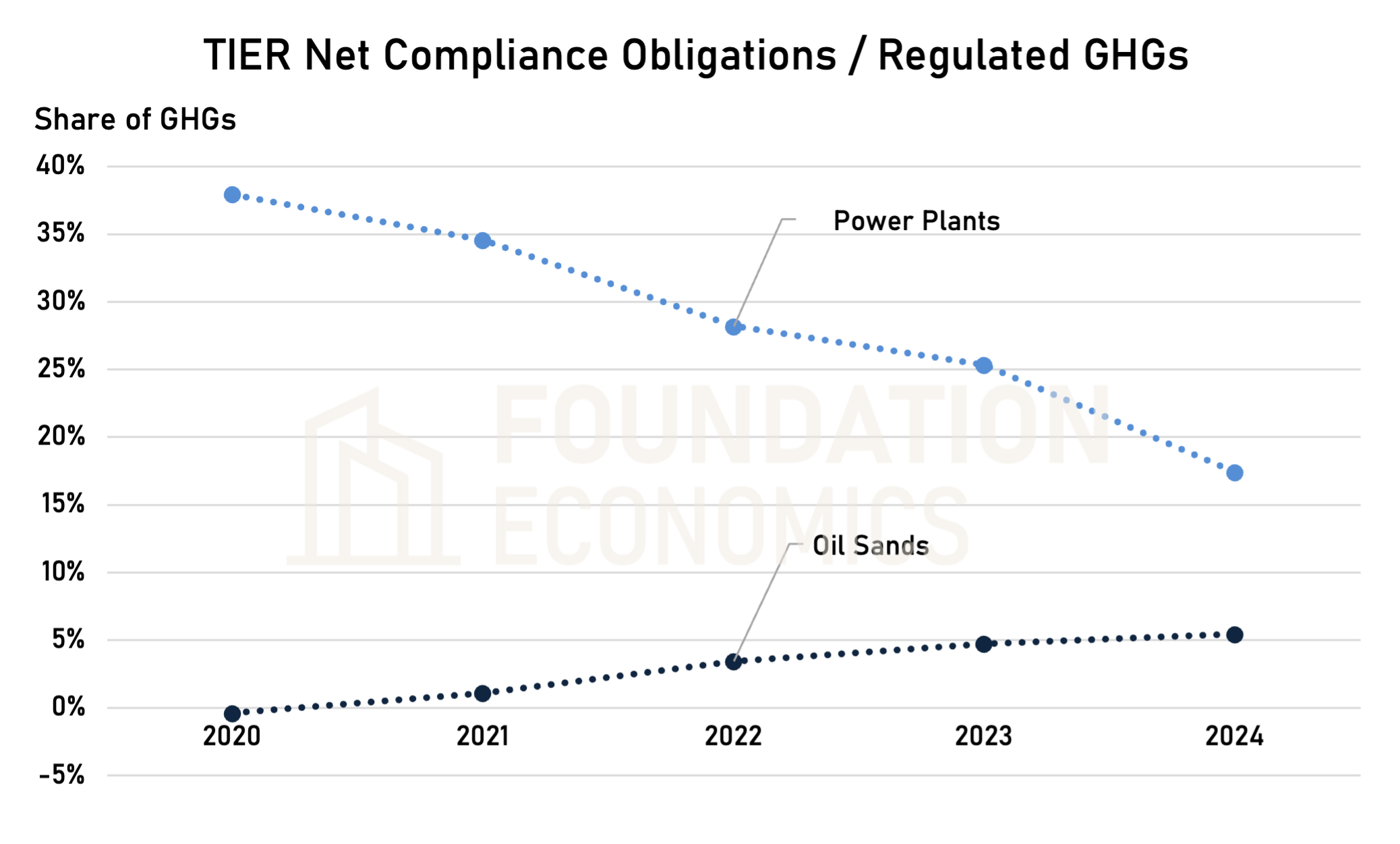

However, despite the increase in GHGs regulated under TIER and general 2% annual tightening of benchmark stringency, compliance obligations in 2024 declined from 2023. Power Plants (again, following from the reduced emission intensity of converted “Coal” generation) drove this continued decline. However, obligations for Oil Sands facilities also declined slightly – underscoring the ongoing reductions in emission intensity across this sector.

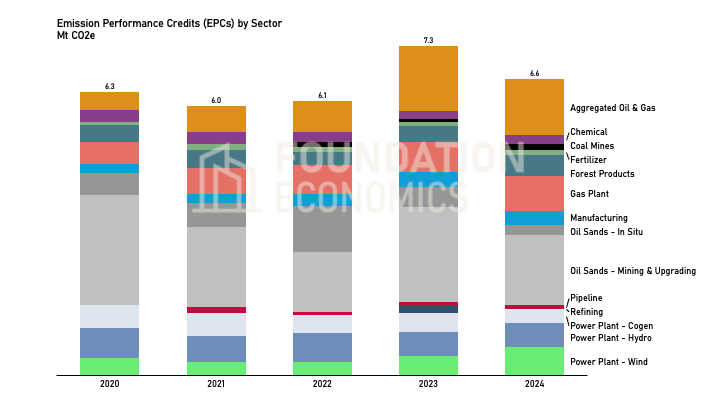

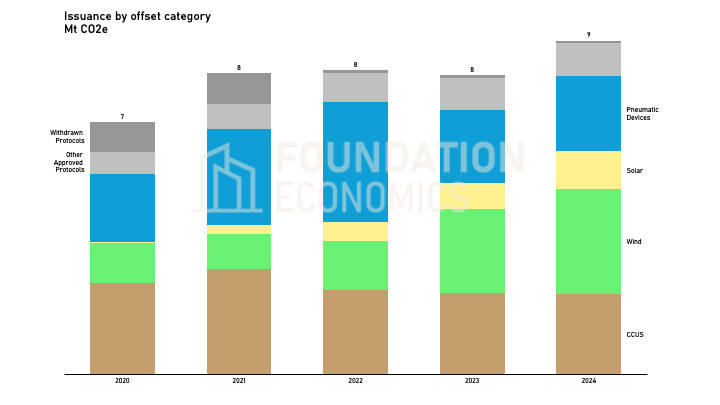

For EPC creation, benchmark tightening generally reduced requested EPCs from 2023 to 2024 across sectors (although EPCs for Gas Plants and Forest Products increased). Nonetheless, increases in Offset creation for 2024 compensated for the reduction in EPC issuance.

As a consequence of emission intensity reductions outpacing benchmark tightening across TIER-regulated facilities, obligations relative to GHGs continued to decline. This decline across TIER-regulated facilities is especially notable for net obligations (i.e., subtracting requested EPCs and Offset issuance from obligations) relative to GHGs.

This top-level trend is also a consequence of the swift reduction of emission intensity across Power Plants – resulting from coal phase-out, conversion to gas-fired generation and the roll-out of renewables. This is exhibited by the rapidly declining share of net obligations (less EPCs and wind and solar Offsets) relative to GHGs for Power Plants.

As a share of GHGs, Oil Sands net obligations (less EPCs and Offsets for Quest CCS) have climbed. However, reductions of Oil Sands emission intensity have buffered the effect of 2% benchmark tightening. 2024 witnessed substantial reductions in emission intensity across In-Situ and Mining & Upgrading facilities.

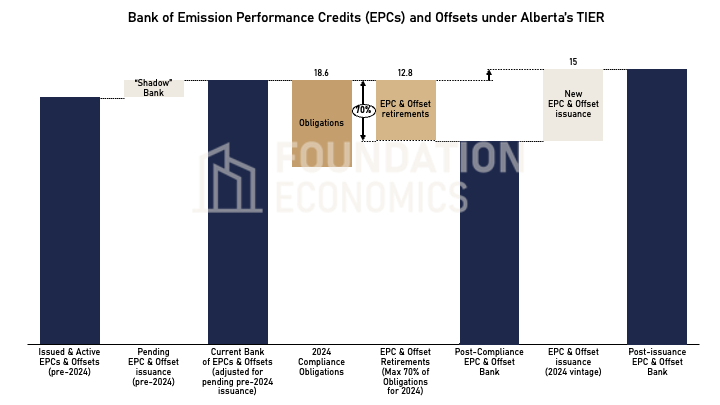

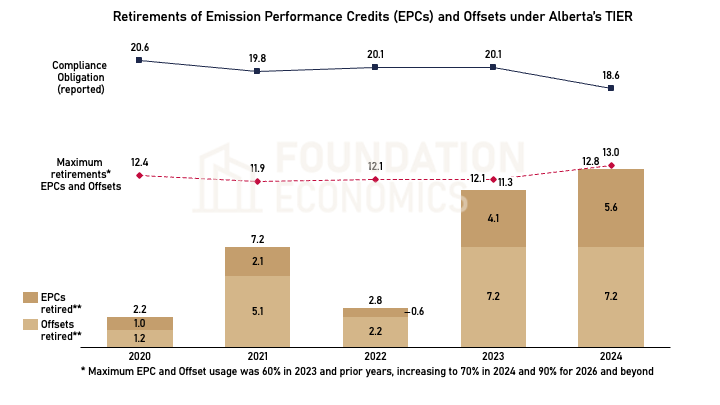

As we elaborated in our July commentary (following observed retirements of EPCs and Offsets in the Alberta Carbon Registries as of the June 30th compliance deadline), TIER participants retired nearly the maximum allowable EPCs and Offsets to satisfy their 2024 obligations. This maximization of retirements was consistent with the present size of the EPC/Offset bank and consequently depressed prices.

Nonetheless, the 2024 limit of 70% for retiring EPCs and Offsets to satisfy obligations means that 2024 EPC and Offset creation will exceed retirements – and increase the overall size of the bank as these requested EPCs are issued.

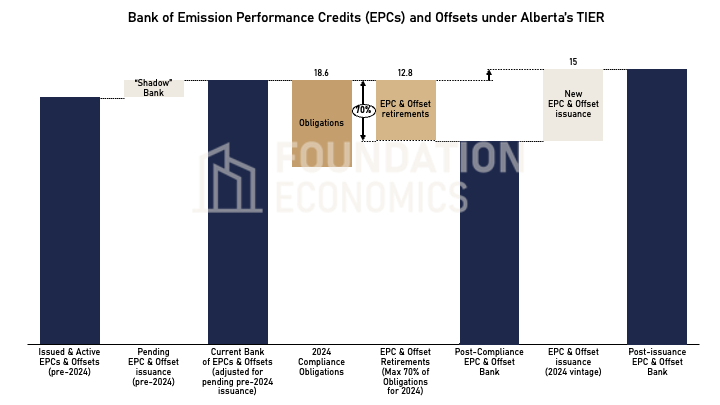

The above exhibit illustrates how the 2024 compliance results will impact the overall EPC/Offset bank. Again, the limit on EPC/Offset retirements at 70% of obligations means that new EPCs and Offsets for 2024 will exceed retirements and, in turn, will result in a growing EPC/Offset bank as requested EPCs and remaining Offsets for 2024 are serialized.

For the outlook of the bank, it is also important to highlight that significant volumes of EPCs and Offsets remain to be issued for prior compliance years – what we term a “Shadow Bank” of requested EPCs and earned Offsets that are not yet serialized in the Alberta Carbon Registries.

Such a growing bank means continued downward pressure on EPC/Offset prices. This is because the TIER Fund price (presently $95/tonne and at which Alberta’s government has stated it will remain for future years) will only “bind” as the marginal cost for compliance once the EPC/Offset bank has been drawn-down by retirements. Accordingly, the discount on EPC/Offset prices tracks the size of the bank relative to obligations – what we shorthand “Years of Inventory”.

For 2025 obligations, facilities’ benchmarks will continue to generally tighten by 2%, and the limit on EPC/Offset retirements will increase to 80% of obligations.

However, the elimination of the federal fuel levy removes the incentive of facilities that opted into TIER to remain within the system, and Alberta announced in September that such facilities would be allowed to opt-out for the 2025 compliance year.

Consequently, the expected opt-out of Aggregate Oil & Gas facilities with obligations will relatively reduce the overall obligations under TIER by over 2 million tonnes annually from 2025 onward.

The resulting market balance in coming years will determine the outlook for EPC/Offset prices. In this context, projections for future emissions, obligations, and creation of EPC and Offsets are essential to understand the outlook for the EPC/Offset bank – and fundamental value for EPCs/Offsets today.

To support market participants and investors, Foundation Economics provides bottom-up modelling of TIER dynamics built from facility-level operational and compliance data.